It's Sunday , December 28 - we attended an early mass @ 6:30 am then went home to have some breakfast. I'm a bit lazy that day but I still I manage to clean the house & wash the dishes. Afterwards, I sat down & watch some dvd movies while my father is sleeping. "Pampatulog po kasi ng tatay ko ang Tv kapag naka-on pero pag in-off , magigising heheh, ganun na ba talaga ang matatanda?".

In the afternoon, I re-read some books & wrote some bible verses as part of my goal - until I fall asleep. I think I must have overslept because I woke up @ 5pm in the afternoon.

Then in the evening, still awake I did some filing arrangement (for my investment) on the filing envelopes I bought last week.

I've been searching this kind of envelope in National Bookstore but it costs P285 (with handle) & P175 (without handle) , a bit expensive for a kuripot like me luckily I found this envelope with handle at metro department store for only P 99.

On this photo you can see I have 5 folders -for Fami, for Philequity, for Ayala philam life, St peter plan & for Pagibig fund. Yes, Pagibig fund, because Pagibig fund is also a mutual fund which I

only knew few months ago, syunga syunga ko no? I already requested for

some printouts on my contributions & have it filed (though its not

yet updated).

I also included the certification of Heritage park lot

that we were able to finish its payment 2 yrs ago (my brother payed

half of it's amount). Plus the St. Peter plan I finished paying last

October.

Just sharing my ordinary experience today!

Have a great day!

From "Pinay Minimum Wager Hardships and Dreams" to "A Cancer Survivor New Journey in Life"

Investing Time @ Home part 2

It's December 27 Saturday, I woke up early again & went to church again with my mother but unlike yesterday there's a lot of people inside, " may binyag at kasal yata". We prayed for a few minutes then afterwards we headed to palengke (C5 palengke & plaza 9). "Ano kaya ang ulam natin?" I answered-"galunggong", I'm a bit "suya " na with pork & beef this past holiday occasion. So I picked 6 pcs of galunggong, when the seller weigh it, " sobra 1/2 na & it's worth P 67.00, "ang mahal naman, di ba P 60.00 per 1/2" I answered. My mother again replied "Hay naku anak, mahal na talaga ang bilihin ngayon". My mother & I are exact opposites, I usually describe her "butas ang kamay" because she doesn't make plans in spending, "kung ano hawak ubos lahat". While I plan a lot & my mother calls me " kuripot".

I again choose 6 pieces of galunggong, this time I choose a little bit smaller ones, & when she weigh it again, "sobra pa rin po - P 60.00 na lng po konti na lang naman ang sobra" & finally she agreed.

I also bought some rugs & kitchen towel both cost P 35.00 each, so I took 2 pcs of rugs & 1 kitchen towel, manong, P 100.00 na lng po ha, tawad na ung P5.00.

"Di ka talaga kuntento na di makatawad " my mother said. " Mahal nga un e, I answered. While heading home we saw again some rugs, when I asked about its price, It's only P 20.00, "di ba mas mura", so I bought another one.

I've been cleaning the house for the past two days, one thing I noticed is the wet floor, since ours is tiled & it's a bit slippery for me specially when its wet. So, I put 3 rugs near the refrigerator, on the sink & near the cr, just to be cautious & to lessen the possibility of accidents.

With our lunch of pritong galunggong with toyo, kamatis, sibuyas na tagalog plus sili as sawsawan, my stomach again was super duper full. In the afternoon, my mother & I went to glorietta / landmark to buy some grocery stuffs. Again, I have a bit tiring & ordinary but wonderful day with the family.

Have a great day a ahead!

God Bless everyone!

I again choose 6 pieces of galunggong, this time I choose a little bit smaller ones, & when she weigh it again, "sobra pa rin po - P 60.00 na lng po konti na lang naman ang sobra" & finally she agreed.

I also bought some rugs & kitchen towel both cost P 35.00 each, so I took 2 pcs of rugs & 1 kitchen towel, manong, P 100.00 na lng po ha, tawad na ung P5.00.

"Di ka talaga kuntento na di makatawad " my mother said. " Mahal nga un e, I answered. While heading home we saw again some rugs, when I asked about its price, It's only P 20.00, "di ba mas mura", so I bought another one.

I've been cleaning the house for the past two days, one thing I noticed is the wet floor, since ours is tiled & it's a bit slippery for me specially when its wet. So, I put 3 rugs near the refrigerator, on the sink & near the cr, just to be cautious & to lessen the possibility of accidents.

With our lunch of pritong galunggong with toyo, kamatis, sibuyas na tagalog plus sili as sawsawan, my stomach again was super duper full. In the afternoon, my mother & I went to glorietta / landmark to buy some grocery stuffs. Again, I have a bit tiring & ordinary but wonderful day with the family.

Have a great day a ahead!

God Bless everyone!

Investing Time @ Home part 1

It's December 26 I woke up early, my mother & I went to sto.nino church to have a quiet moment inside. I have been wanting to have this kind of routine everyday unfortunately my work has been draining my energy for years. It's a good thing I have a long holiday vacation so I can now finally do it everyday.

Afterwards we headed to palengke & bought some rekado for lunch, my plan today was to eat just a little for lunch since my stomach has been overloaded for the past three days because of the holiday events.

Sadly, my plan was sabotage when my mother cooked her pacham (short for pachambang luto), pinaghalong puchero, sinigang at nilagang manok, heheh. "Hayun napasarap na naman ang kain" Then afterwards, we watch some dvd movie (The Hitman) while having some little kwentuhan (di ko alam mahilig na sa showbiz news ang tatay ko heheh).

After watching, I decided to do a general cleaning on our living & dining area, while everyone is asleep upstairs. It's been a while since I've done some general cleaning here.

At night, our bunso volunteered " ma, ako bahala sa hapunan". He bought inihaw na salmon & tilapia & prepares ensaladang talong. And the result, super duper busog, wahhh- 32" na ang waistline ko. Good thing, my mother blended some carrots & apples atleast I can drink some of it again in the morning for detoxification.

Just an ordinary day but I really treasure these ordinary activities!

Have a blessed weekend guys

Afterwards we headed to palengke & bought some rekado for lunch, my plan today was to eat just a little for lunch since my stomach has been overloaded for the past three days because of the holiday events.

Sadly, my plan was sabotage when my mother cooked her pacham (short for pachambang luto), pinaghalong puchero, sinigang at nilagang manok, heheh. "Hayun napasarap na naman ang kain" Then afterwards, we watch some dvd movie (The Hitman) while having some little kwentuhan (di ko alam mahilig na sa showbiz news ang tatay ko heheh).

After watching, I decided to do a general cleaning on our living & dining area, while everyone is asleep upstairs. It's been a while since I've done some general cleaning here.

At night, our bunso volunteered " ma, ako bahala sa hapunan". He bought inihaw na salmon & tilapia & prepares ensaladang talong. And the result, super duper busog, wahhh- 32" na ang waistline ko. Good thing, my mother blended some carrots & apples atleast I can drink some of it again in the morning for detoxification.

Just an ordinary day but I really treasure these ordinary activities!

Have a blessed weekend guys

Christmas 2014

I was a bit busy these past few days because of the holiday season and it's only today December 27 that I am relaxing & enjoying watching dvd movies in our house while writing this post.

December 23, was the last day of our work and its a bit late when i went home.

December 24, we rushed early to Market Market mall for some late minute shopping of gifts & groceries. As usual fruit salad is the only food I can make & share for noche buena. I just bought cake & ready made ube & leche plan @ Fiesta Market (Oh dear, I still not done with one of my goals which is cooking, huhuh).

I only bought few gifts for my close relatives while I decided to give cash for my inaanaks (just 200 pesos each while the 50 pesos & 20 pesos or the sabit) Hey, atleast I only spent 2 thousand for my inaanaks unlike those past christmas I usually overspent for the gifts plus "ang sakit sa ulong mag isip ng pang regalo."

We spent our Christmas day @ Bacoor Cavite with our relatives. It's already a tradition since I was a child to celebrate our Christmas there.

It's a bit tiring when we got home but it's really worth it, you know how wonderful the celebration in the Philippines is being with our families & our love ones during christmas.

Happy New Year Guys!

December 23, was the last day of our work and its a bit late when i went home.

December 24, we rushed early to Market Market mall for some late minute shopping of gifts & groceries. As usual fruit salad is the only food I can make & share for noche buena. I just bought cake & ready made ube & leche plan @ Fiesta Market (Oh dear, I still not done with one of my goals which is cooking, huhuh).

I only bought few gifts for my close relatives while I decided to give cash for my inaanaks (just 200 pesos each while the 50 pesos & 20 pesos or the sabit) Hey, atleast I only spent 2 thousand for my inaanaks unlike those past christmas I usually overspent for the gifts plus "ang sakit sa ulong mag isip ng pang regalo."

We spent our Christmas day @ Bacoor Cavite with our relatives. It's already a tradition since I was a child to celebrate our Christmas there.

It's a bit tiring when we got home but it's really worth it, you know how wonderful the celebration in the Philippines is being with our families & our love ones during christmas.

Happy New Year Guys!

FAMI - Equity Fund

I have been checking the FAMI sites almost every other day. Based on their historical NAVPS I think --"mas may movement ng konti ang equity fund nila vs balanced fund this year" ( Balanced fund Jan Navps - 2.70 vs Dec Navps - 2.77 / Equity Fund Jan Navps - 4.80 vs Dec Navps - 5.50 ) . So instead of making additional top up on my balanced fund I decided to open an equity fund last week.

I have written reviewing-my-numbers post last week about my 3k plan from paluwagan allocated for my mutual fual fund and deposited it right after I received it.

While the remaining balance for the 5k was taken from the cash rebates from credit card I set aside last month & the lending cap & interest I received this December.

There it goes. I can now reward myself for all the goals I have accomplished this year. I'll be visiting letsfaceitsalon & laybare for some facial cleaning activity & probably watch the hobbit movie this week :).

Plus I'll try to accomplish also the 3 remaining goals I have written in this site.

Have a Wonderful Christmas again everyone!

I have written reviewing-my-numbers post last week about my 3k plan from paluwagan allocated for my mutual fual fund and deposited it right after I received it.

|

| Total = P 5,110.00 / Change = P 110.00 will be deposited in my savings account :) |

There it goes. I can now reward myself for all the goals I have accomplished this year. I'll be visiting letsfaceitsalon & laybare for some facial cleaning activity & probably watch the hobbit movie this week :).

Plus I'll try to accomplish also the 3 remaining goals I have written in this site.

Have a Wonderful Christmas again everyone!

Last Financial Goal 2014

Finally, I can say I did it!

Done with my last financial goal this year. I've written a post last October -"figuring-out-what-to-do-next" about the four specific financial goal I need to start this year. Yesterday, I went to WealthBank to open a special savings account with a minimum deposit of P 10,000.00 @1.75% interest per annum with a 30 day term period. I plan to make additional deposit every month. This account will be use for my plan to study next year. I have talked to one of our neighbor who's also studying a course which only has an additional 1 year to finish as some of my previous subjects will be credited. I graduated a 3-yr course from TUP which is unfortunately not the field that I really want.Hopefully this plan will pursue next year. I feel the need to improve myself. I think I have to sacrifice a year or two so I can have a better & stable future. I'll be inquiring on that university by February and probably by May will be the start of class just need to confirm it.

I'll be turning 40 by January. Well, it's better late than never for some personal improvements, di ba? Wala naman akong asawa at anak, so I think I'll survive just need a little preparations.

Yes, I do worry being a minimum wager but It's not exactly an issue why I decided to study next year. I just feel the need for me to find a purpose in life, a purpose that will also influence other people. Sometimes at the end of the day, no matter how hard my work is, how meager my salary is and how exhausted I feel - that sense of fulfillment is needed for me to be whole & complete.

Merry Christmas everyone!

Reviewing My Numbers

Time flies so fast & its December 19 already, feels like it was only yesterday when I wrote my goals last January. Today, I was reading some of my blog posts & these particular numbers caught my eye.

One Peso (P1.00) - It only took one peso to start another step towards financial freedom. Just one peso & my savings motivation (365-savings-goal) started last year.

One Hundred Pesos (P100) - The average amount I set for my daily allowance (Daily budget of P100, P140, P160). I have set my daily routine to a fixed expenses though I sometimes exceeded with my budget its still manageable.

One Thousand Pesos (P1,000) - The target amount I have set for my Weekly budget, my Groceries expenses and my Minimum additional top up on my investments. I've already reached my target additional top up investment here but I sometimes exceeded with my weekly budget & my groceries expenses.

Ten Thousand Pesos (P10,000) - The target amount I have set for my Total monthly expenses (though I think its doable I'm still in the process of trimming down my expenses), my Total investment on my mutual funds (target reached both for FAMI & PEMI) and the Special Savings Account (my last goal to fulfill before 2014 ends ).

One Hundred Thousand Pesos (P100,000) - I've been visualizing this numbers since I wrote this 1,000 Spending Rule blogpost last August. Just imagine to have a total of P100,000 both on my savings, mutual fund & other investments----Sounds good, di ba? I'll see if I can reach it before the year ends or before I turn 40 next year. I'll be calculating my networth before the year 2014 ends :)

My 13th month pay is P 6,150 (ang laki noh?) - is primarily intended for gifts both on my family, friends & inaanaks though I have not received it yet, still okay with me, "atleast controlled ang gastos". I planned to give cash on my inaanaks coz I still am not sure if all of them are coming.

I have this spending problem every Christmas, an attitude of giving everyone a gift then ended up broke by January. This year every single centavo is planned. No new christmas decors, new curtains, new beddings & no household items were bought, hey I'm a self confessed addict to anything that can add appeal to my eye in decorating our house every christmas.

Our "paluwagan" were already given yesterday but just as I plan, the 10k will be for my special savings account, 6k will be for medical ( cervical vaccine, health cards for me & my mother ), 3k for my mutual fund, while the remaining 5k will be for church, for christmas panggastos & for some house repairs.

Setting a goal really plays an important role in our lives coz it sets directions in every plan that we make. I'm looking forward & excited for 2015 as I now have a clear view of what I really want in my life. Though my blog is all about financial goals, I'll be focusing on personal improvements next year.

Have a great weekend everyone!

One Peso (P1.00) - It only took one peso to start another step towards financial freedom. Just one peso & my savings motivation (365-savings-goal) started last year.

One Hundred Pesos (P100) - The average amount I set for my daily allowance (Daily budget of P100, P140, P160). I have set my daily routine to a fixed expenses though I sometimes exceeded with my budget its still manageable.

One Thousand Pesos (P1,000) - The target amount I have set for my Weekly budget, my Groceries expenses and my Minimum additional top up on my investments. I've already reached my target additional top up investment here but I sometimes exceeded with my weekly budget & my groceries expenses.

Ten Thousand Pesos (P10,000) - The target amount I have set for my Total monthly expenses (though I think its doable I'm still in the process of trimming down my expenses), my Total investment on my mutual funds (target reached both for FAMI & PEMI) and the Special Savings Account (my last goal to fulfill before 2014 ends ).

One Hundred Thousand Pesos (P100,000) - I've been visualizing this numbers since I wrote this 1,000 Spending Rule blogpost last August. Just imagine to have a total of P100,000 both on my savings, mutual fund & other investments----Sounds good, di ba? I'll see if I can reach it before the year ends or before I turn 40 next year. I'll be calculating my networth before the year 2014 ends :)

My 13th month pay is P 6,150 (ang laki noh?) - is primarily intended for gifts both on my family, friends & inaanaks though I have not received it yet, still okay with me, "atleast controlled ang gastos". I planned to give cash on my inaanaks coz I still am not sure if all of them are coming.

I have this spending problem every Christmas, an attitude of giving everyone a gift then ended up broke by January. This year every single centavo is planned. No new christmas decors, new curtains, new beddings & no household items were bought, hey I'm a self confessed addict to anything that can add appeal to my eye in decorating our house every christmas.

Our "paluwagan" were already given yesterday but just as I plan, the 10k will be for my special savings account, 6k will be for medical ( cervical vaccine, health cards for me & my mother ), 3k for my mutual fund, while the remaining 5k will be for church, for christmas panggastos & for some house repairs.

Setting a goal really plays an important role in our lives coz it sets directions in every plan that we make. I'm looking forward & excited for 2015 as I now have a clear view of what I really want in my life. Though my blog is all about financial goals, I'll be focusing on personal improvements next year.

Have a great weekend everyone!

Understanding My Risk Tolerance

I'm not a risk taker maybe that's one of the reason why I'm still single, hahah. Kidding aside, early this year I became interested with mutual funds & uitf's as I feel that I'm still not ready with stock investing.

Everytime I visit the sites of different mutual funds the word "risks" is always present.

I went to BDO & ask for their investment products, they will initially inform me "Ma'am, mataas po ang risks ng equity fund ha."

I went to ChinaBank to ask again for Equity fund & Balanced Fund, both have an initial investment of 50k & 10k as an additional investment". One of their staffs assisted me with my inquiries with a little introduction of an investment product she was offering which I politely decline, as I answered her "hindi ko kasi kaya ang investment na may monthly obligation maliit lang kasi ang sahod ko, baka pumalya ako at di ko matapos." I'm interested with UITF & how it works, she answered "basta kapag nagplace ka ng investment monitor mo lang kasi everyday nagpa-flactuate ang value kaya hindi agad guaranteed ang returns in a short span of time."Still di pa rin nag-sink in ang information sa sarili ko."

Again I inquire to Philam life, one of their agents answered me, "Kapag bumili ka ng 10 shares at ang value ng share is 5.00 ngayon, your investment value is P 50.00. Then after 1 year gusto mong kunin ang share mo pero ang value is P2.00---then 20.00 na lang ang makukuha mo."

Okay I got it, I know it, but do I understand it? My answer that time is still NO. " Parang ang hirap mag-invest na alam mong may posibleng losses after a year, ganyan po kasing mag-isip ang karaniwang taong katulad ko." But then I was thinking, " bakit sila nag-iinvest pa rin kahit may risk?" It made me think again - "siguro mas malaki rin ang future gains", maybe it's just a matter of having a time frame for every investment. Well, I am still in the process of learning here.

So I proceeded with my plan, how will I know If I 'm not going to try it - last July 7, I opened a balanced fund in FAMI (I chose a fund with a moderate risk), so when they ask me- you know the risks mam? I answered yes.

Today, I was checking some files, when I found this peso cost averaging excel template I downloaded from ready to be rich site & input some datas from my mutual funds. So glad when I found this template coz I'm a total idiot with this excel software.

In

these PCA templates from Philequity & FAMI balanced fund where I

both invested a total of P 10,000, a Sales Load of P 2.0% & 3.50%

we're automatically deducted from it respectively & stock value

shown was a little bit low from the total amount I invested.

Now seeing those templates, I can say that I now understand what risk is. I have prepared myself mentally & emotionally that the value of my shares flactuates as I have been stalking the sites of both FAMI & PEMI thrice a week. And today the NAVPS of my FAMI balanced fund is - 2.74 which is below the value of my initial investment. As for the PEMI, the value of my equity fund today is 36.77 which is again below the value of my initial investment but that's okay with me (mag-iisang buwan pa lang naman), I now understand the actual feeling, "kaya pala ganun ang feeling nila." :)

Knowing is actually different from understanding, I can say that I know the facts but to actually experience it is important. Hey, I'm a slow learner that's why I don't give advises, If somebody calls me an idiot "I don't really care".What's important to me is I'm learning & I keep on learning through some of my experiences & through constant pursuit of knowledge.

It's really an advantage that internet was invented so there's no excuse now not to be financially aware as most of the informations we're actually given free from facebook, you tubes & other financial blogsites today.

Just sharing again!

Happy Weekend & Happy Investing!

Everytime I visit the sites of different mutual funds the word "risks" is always present.

I went to BDO & ask for their investment products, they will initially inform me "Ma'am, mataas po ang risks ng equity fund ha."

I went to ChinaBank to ask again for Equity fund & Balanced Fund, both have an initial investment of 50k & 10k as an additional investment". One of their staffs assisted me with my inquiries with a little introduction of an investment product she was offering which I politely decline, as I answered her "hindi ko kasi kaya ang investment na may monthly obligation maliit lang kasi ang sahod ko, baka pumalya ako at di ko matapos." I'm interested with UITF & how it works, she answered "basta kapag nagplace ka ng investment monitor mo lang kasi everyday nagpa-flactuate ang value kaya hindi agad guaranteed ang returns in a short span of time."Still di pa rin nag-sink in ang information sa sarili ko."

Again I inquire to Philam life, one of their agents answered me, "Kapag bumili ka ng 10 shares at ang value ng share is 5.00 ngayon, your investment value is P 50.00. Then after 1 year gusto mong kunin ang share mo pero ang value is P2.00---then 20.00 na lang ang makukuha mo."

Okay I got it, I know it, but do I understand it? My answer that time is still NO. " Parang ang hirap mag-invest na alam mong may posibleng losses after a year, ganyan po kasing mag-isip ang karaniwang taong katulad ko." But then I was thinking, " bakit sila nag-iinvest pa rin kahit may risk?" It made me think again - "siguro mas malaki rin ang future gains", maybe it's just a matter of having a time frame for every investment. Well, I am still in the process of learning here.

So I proceeded with my plan, how will I know If I 'm not going to try it - last July 7, I opened a balanced fund in FAMI (I chose a fund with a moderate risk), so when they ask me- you know the risks mam? I answered yes.

Today, I was checking some files, when I found this peso cost averaging excel template I downloaded from ready to be rich site & input some datas from my mutual funds. So glad when I found this template coz I'm a total idiot with this excel software.

|

| My FAMI peso cost averaging data |

|

| My Philequity peso cost averaging data |

Now seeing those templates, I can say that I now understand what risk is. I have prepared myself mentally & emotionally that the value of my shares flactuates as I have been stalking the sites of both FAMI & PEMI thrice a week. And today the NAVPS of my FAMI balanced fund is - 2.74 which is below the value of my initial investment. As for the PEMI, the value of my equity fund today is 36.77 which is again below the value of my initial investment but that's okay with me (mag-iisang buwan pa lang naman), I now understand the actual feeling, "kaya pala ganun ang feeling nila." :)

Knowing is actually different from understanding, I can say that I know the facts but to actually experience it is important. Hey, I'm a slow learner that's why I don't give advises, If somebody calls me an idiot "I don't really care".What's important to me is I'm learning & I keep on learning through some of my experiences & through constant pursuit of knowledge.

It's really an advantage that internet was invented so there's no excuse now not to be financially aware as most of the informations we're actually given free from facebook, you tubes & other financial blogsites today.

Just sharing again!

Happy Weekend & Happy Investing!

Another Goal Reached!!!

Then after my brother gave me his monthly rent last November 30 & the P 2,000.00 was then again deposited to Philequity fund last December 5.

Good thing my mother & I decided not pursue our plan to relocate her washing machine, I was able to use the 1k budget from it plus the St Peter contribution of P 550.00 was returned to me (kumpleto na pala ang payment ko hahah) & the company profit shares I received last November & finally last December 9 another P 2,000.00 was deposited again to Philequity fund reaching my target goal of P 10,000.00 to my equity fund in PEMI.

Just one more financial goal to achieve this 2014 before I can finally say "I did it". Though we are still waiting for some good news on our 13th month pay & our paluwagan here in our office, I'm still optimistic that I'll be able to open a special savings account of P 10,000.00 before the year ends.

Just in the mood of sharing again.

Have a great weekend guyz!!!!

Being Poor is a Challenge - Part 1

I was browsing the internet today when I saw & read this abs-cbnnews article posted last year. Would you imagine 18 million Filipinos are actually living by P50/day? It made me recall some of my experiences and compare it today.

I was born poor. I grew up with a not exactly an irresponsible father but an immature one & a strong mother who was able to survive us (me & my 3 siblings) inspite of all the hardships & difficulties before. I am not writing this just to get sympathy as I myself don’t like the feeling of “kinaawaan” or just to sell a story as I don’t have any financial gain on this blog right now. Though I may not belong to the poorest of the poor as seen on the documentary series on television, I know what it feels like to be a poor - to have nothing, to have an empty stomach, to have an empty pocket, to almost lost a shelter to live & to almost lost a chance to go to school as I would always cry to my mother before “ma, pasukan na bukas hindi pa kami naka-enroll” but eventually my mother got us enrolled on the first day of school.

But do you know what it really feels like to have nothing? Here are some examples of real life scenario - a comparison of having nothing & actually having something.

"You know the feeling & the smell of course", "o di ba ang baho, at ang sama sa pakiramdam?"

1. But then you need to take a bath, let's say a person took a bath but with no soap just water, "a little refreshing but the smell is still in there, right?"

2. Let's say a person took a bath but use a laundry soap because there's no bath soap." a little refreshing & you will feel clean afterwards but there's no fragrant smell and a dry skin afterwards, right."

I know the feeling because I once experienced it. "tumira kami sa tabing riles at pinapaliguan kami araw araw gamit ang sabong panlaba,kaya balat kalabaw po ako, hahah."

3. Then let's say a person took a bath with bath soap & shampoo. "the feeling so great you will feel refresh, clean & fragrant afterwards".

4. Let's say a person took a bath with bath soap, shampoo, conditioner, body wash & facial scrub. "that's a luxury for me already but for middle rich ones they are just necessities right?"

5. And finally, taking a bath on a Jacuzzi with moisturizers, rose petals & fragrant oils in it. "well that's for the super rich ones."

I can only speak for myself & the good thing during my younger years is that my mother does not let us out in the streets but there were times when we wake up in the morning without nothing to eat & my mother will find a way for it.

Given this scenario - "We woke up & feel hungry but we have nothing to eat & for hours we wait for our mother to come & when she finally arrived she only got rice."

1. So we need to eat that rice, just the rice (nothing else) because we need to ease our hunger.

2. Then another day, our mother brought a rice again still "no ulam."

We need to eat that rice again but there's bonus- "a little sugar or salt /little toyo or mantika added so it may taste like adobo, o di ba mas may lasa."

3.Then another day we need to eat that rice again but my mother gave me 1 peso. So I bought mangga & bagoong plus talbos ng kamote from the backyard placed above the sinaing, ang sarap di ba, Oh, I love mangga & bagoong plus talbos ng kamote with kamatis.

4. Then another day my mother has some earnings when she arrived -so she cooked ginataang laing, sinigang na buto buto ng baboy, pritong galunggong with mangga at bagoong with ginataang halo halo for meryenda... " it feels like fiesta for me already but for the middle rich it's just ordinary, right?"

5. And today there's a lot of food chains & restaurants, on the mall where the middle rich people eat & those fancy & high end restaurants in hotels for the super rich ones.

But what's my point here? Poverty is not a good topic in this world of financial blogs as I do not encourage it. But I have been an observant as to what's been happening in our society & I have observed one thing the rich ones are getting richer because they keep on earning, saving & investing while poor ones keeps on spending all their earnings.

As I once read in Daily Bread ,

" I asked for riches that I might be happy,

but I was given poverty that I might be wise."

The poor ones didn't recognize what God had given us.

The lessons those experiences taught us because we know how it feels to have nothing.

Yes, we we're born poor but if we were born rich, would we know the difference?

Would I actually know the advantage of having a laundry soap than nothing while taking a bath.

Would I appreciate the importance of rice even with just a little taste on it than to have nothing on my stomach, right?

So if you were born poor then be wise because that's what God is actually teaching us.

Yes we need to spend to help our economy but then let the rich people spend their money while the poor people spend wisely.

If you're a minimum wage earner like me, challenge yourselves. Spend wisely, spend on things that are needed & not on things that you just wanted. Save because we know how it feels to have nothing. Invest because we need to prepare ourselves for a better future.

Just imagine how great our country will be, if those 18 million poor Filipinos change their mindsets & becomes rich in the future :)

Philippines maybe a third world country & I believe our country will rise up.

There's a reason why God chooses us to be born here in the Philippines because even if at times we have nothing we still believe that there's God who loves us & will never leave us no matter what.

Just sharing some thoughts today.

Have a blessed weekend!!!

Ps. The above scenario are my actual experience from 1st to 4th .

I was born poor. I grew up with a not exactly an irresponsible father but an immature one & a strong mother who was able to survive us (me & my 3 siblings) inspite of all the hardships & difficulties before. I am not writing this just to get sympathy as I myself don’t like the feeling of “kinaawaan” or just to sell a story as I don’t have any financial gain on this blog right now. Though I may not belong to the poorest of the poor as seen on the documentary series on television, I know what it feels like to be a poor - to have nothing, to have an empty stomach, to have an empty pocket, to almost lost a shelter to live & to almost lost a chance to go to school as I would always cry to my mother before “ma, pasukan na bukas hindi pa kami naka-enroll” but eventually my mother got us enrolled on the first day of school.

But do you know what it really feels like to have nothing? Here are some examples of real life scenario - a comparison of having nothing & actually having something.

1st Scenario

What's the difference between a person who took a bath & a person who don't?"You know the feeling & the smell of course", "o di ba ang baho, at ang sama sa pakiramdam?"

1. But then you need to take a bath, let's say a person took a bath but with no soap just water, "a little refreshing but the smell is still in there, right?"

2. Let's say a person took a bath but use a laundry soap because there's no bath soap." a little refreshing & you will feel clean afterwards but there's no fragrant smell and a dry skin afterwards, right."

I know the feeling because I once experienced it. "tumira kami sa tabing riles at pinapaliguan kami araw araw gamit ang sabong panlaba,kaya balat kalabaw po ako, hahah."

3. Then let's say a person took a bath with bath soap & shampoo. "the feeling so great you will feel refresh, clean & fragrant afterwards".

4. Let's say a person took a bath with bath soap, shampoo, conditioner, body wash & facial scrub. "that's a luxury for me already but for middle rich ones they are just necessities right?"

5. And finally, taking a bath on a Jacuzzi with moisturizers, rose petals & fragrant oils in it. "well that's for the super rich ones."

2nd Scenario

Do you know what it feels like to have an empty stomach,to actually have nothing to eat ?I can only speak for myself & the good thing during my younger years is that my mother does not let us out in the streets but there were times when we wake up in the morning without nothing to eat & my mother will find a way for it.

Given this scenario - "We woke up & feel hungry but we have nothing to eat & for hours we wait for our mother to come & when she finally arrived she only got rice."

1. So we need to eat that rice, just the rice (nothing else) because we need to ease our hunger.

2. Then another day, our mother brought a rice again still "no ulam."

We need to eat that rice again but there's bonus- "a little sugar or salt /little toyo or mantika added so it may taste like adobo, o di ba mas may lasa."

3.Then another day we need to eat that rice again but my mother gave me 1 peso. So I bought mangga & bagoong plus talbos ng kamote from the backyard placed above the sinaing, ang sarap di ba, Oh, I love mangga & bagoong plus talbos ng kamote with kamatis.

4. Then another day my mother has some earnings when she arrived -so she cooked ginataang laing, sinigang na buto buto ng baboy, pritong galunggong with mangga at bagoong with ginataang halo halo for meryenda... " it feels like fiesta for me already but for the middle rich it's just ordinary, right?"

5. And today there's a lot of food chains & restaurants, on the mall where the middle rich people eat & those fancy & high end restaurants in hotels for the super rich ones.

But what's my point here? Poverty is not a good topic in this world of financial blogs as I do not encourage it. But I have been an observant as to what's been happening in our society & I have observed one thing the rich ones are getting richer because they keep on earning, saving & investing while poor ones keeps on spending all their earnings.

As I once read in Daily Bread ,

" I asked for riches that I might be happy,

but I was given poverty that I might be wise."

The poor ones didn't recognize what God had given us.

The lessons those experiences taught us because we know how it feels to have nothing.

Yes, we we're born poor but if we were born rich, would we know the difference?

Would I actually know the advantage of having a laundry soap than nothing while taking a bath.

Would I appreciate the importance of rice even with just a little taste on it than to have nothing on my stomach, right?

So if you were born poor then be wise because that's what God is actually teaching us.

Yes we need to spend to help our economy but then let the rich people spend their money while the poor people spend wisely.

If you're a minimum wage earner like me, challenge yourselves. Spend wisely, spend on things that are needed & not on things that you just wanted. Save because we know how it feels to have nothing. Invest because we need to prepare ourselves for a better future.

Just imagine how great our country will be, if those 18 million poor Filipinos change their mindsets & becomes rich in the future :)

Philippines maybe a third world country & I believe our country will rise up.

There's a reason why God chooses us to be born here in the Philippines because even if at times we have nothing we still believe that there's God who loves us & will never leave us no matter what.

Just sharing some thoughts today.

Have a blessed weekend!!!

Ps. The above scenario are my actual experience from 1st to 4th .

Another Financial Challenge Accepted

Getting a life insurance is not on my goal lists as I think the need for it is not necessary for an individual like me who does'nt have kids yet.

But almost 6 years ago our company took a BPI Philam life insurance with a 200k coverage payable for 8 years. Half of its premium is automatically deducted from our salary (only P 172.81 / payday) while the remaining half was paid by them.

Last month, our company informed us that they can no longer pay half of its premium since they are having hard time with their collectibles as most of the clients are not paying their dues in time. I hope they consult a lawyer now so they will know what appropriate legal moves needs to be done with those delinquent clients who aren't bothered with their credit dues.

Would you imagine "Ilang milyon ang pautang & kung ilang taon na hindi sila nagbabayad"? Oh well it's their problem, I'll just pray that those who are in position will seriously work for a solution -- but my problem now is they gave us the billing last month & handed us the full responsibility of paying it & we have until December 2 to settle it. Should we decide to continue the policy or not, it's up to us.

Yes, I need to pay that P 2,073.68 in full and though my focus is to save for my mutual as a I have a target goal for this year but then I need to take some considerations in deciding what needs to be prioritize.

Some of my colleagues here we're saying "pag nakautang na ko dyan di ko na itutuloy" while some says " aanhin pa ang damo kapag patay na ang kabayo, di ko na babayaran yan." As I have told them, "hindi naman para sa inyo yan para sa anak nyo yan, mabuti ako wala pa akong anak." but still I plan to continue it even if it's not on my budget list. As I have told them, "sayang naman naka 6 yrs na tayo, just 2 years only fully paid na ang policy & we're already insured for life with an accident insurance as an added feature".

Good thing I have set aside my two months earning (P 1,350.00) from lending though it was intended for my equity fund, & the company profit sharing (P 430.00) I received last month, plus a little sacrifice from my daily allowance ( P293.00) and finally I was able to pay my life insurance in full yesterday.

It's easy for me to ignore that life insurance plan but then it is "sayang" if I just give it up considering the pros & cons it gives.

And though mam jill says that plan is a bit expensive still that remaining two years of payment (total of P 16,584.44) compared to a P200k coverage for life insurance has a big difference right?

Have a great day guys!!!

But almost 6 years ago our company took a BPI Philam life insurance with a 200k coverage payable for 8 years. Half of its premium is automatically deducted from our salary (only P 172.81 / payday) while the remaining half was paid by them.

Last month, our company informed us that they can no longer pay half of its premium since they are having hard time with their collectibles as most of the clients are not paying their dues in time. I hope they consult a lawyer now so they will know what appropriate legal moves needs to be done with those delinquent clients who aren't bothered with their credit dues.

Would you imagine "Ilang milyon ang pautang & kung ilang taon na hindi sila nagbabayad"? Oh well it's their problem, I'll just pray that those who are in position will seriously work for a solution -- but my problem now is they gave us the billing last month & handed us the full responsibility of paying it & we have until December 2 to settle it. Should we decide to continue the policy or not, it's up to us.

Yes, I need to pay that P 2,073.68 in full and though my focus is to save for my mutual as a I have a target goal for this year but then I need to take some considerations in deciding what needs to be prioritize.

Some of my colleagues here we're saying "pag nakautang na ko dyan di ko na itutuloy" while some says " aanhin pa ang damo kapag patay na ang kabayo, di ko na babayaran yan." As I have told them, "hindi naman para sa inyo yan para sa anak nyo yan, mabuti ako wala pa akong anak." but still I plan to continue it even if it's not on my budget list. As I have told them, "sayang naman naka 6 yrs na tayo, just 2 years only fully paid na ang policy & we're already insured for life with an accident insurance as an added feature".

Good thing I have set aside my two months earning (P 1,350.00) from lending though it was intended for my equity fund, & the company profit sharing (P 430.00) I received last month, plus a little sacrifice from my daily allowance ( P293.00) and finally I was able to pay my life insurance in full yesterday.

It's easy for me to ignore that life insurance plan but then it is "sayang" if I just give it up considering the pros & cons it gives.

And though mam jill says that plan is a bit expensive still that remaining two years of payment (total of P 16,584.44) compared to a P200k coverage for life insurance has a big difference right?

Have a great day guys!!!

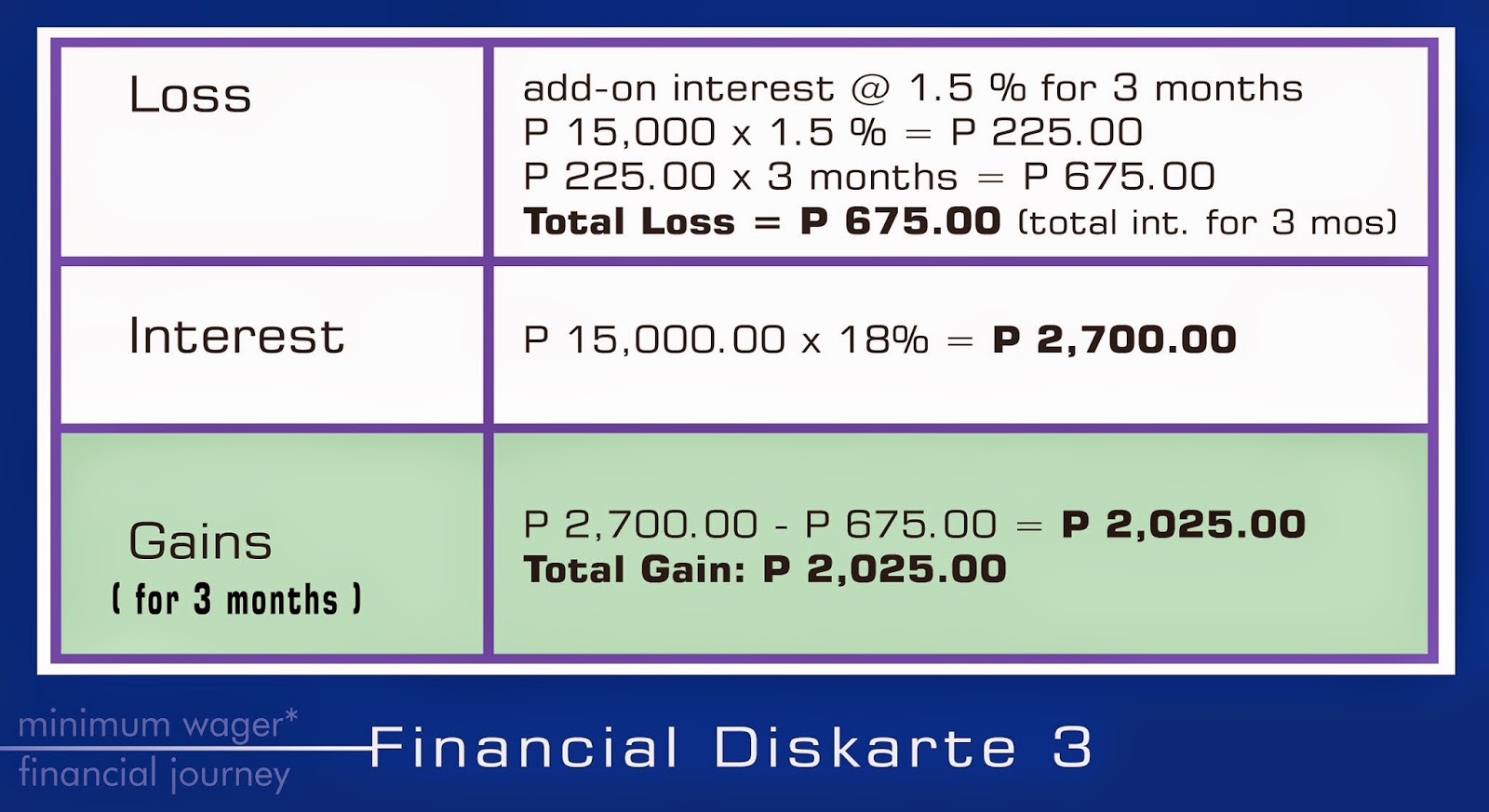

Financial Diskarte 3

Scenario 1

I was looking @ my credit card bill & checking all my transactions last September when I suddenly remember, "Naku, mag - October na pala next month, naku baka di ko abot ang points ko annual fee reversal kailangan ko mag-cash loan para ma-waive ang annual fee ko" then one of my office mate overheard me & she volunteered.

Scenario 2

I was about to confirm the loan to my contact agent on that credit card company when one of my officemate heard me & said "di ba nagsabi na rin ko sau?", okay then.Final decision - I made a P 15,000.00 cash loan again @ Eastwest last September @ 1.5% add on payable for three months.

Our company took Life Insurance plan from BPI Philam almost 6yrs ago & as per agreement half of its premium will be paid by the company while the other half will automatically deducted from our salary. Last month, our company handed over us the responsibility of paying its full quarterly premiums since the financial status of our company is not doing well today because most of our clients are not paying well too.

I still dont want to touch my emergency fund, I decided to use my two months earning here just a little amount to be added by next week I'll be paying my life insurance quarterly premium in full.

Life is really full of complexities no matter how much we plan for it but then we have to be flexible in dealing with it.

Have a great weekend guys =)

Finally 'got an equity fund in PEMI!

I have previously written a post here about all the four specific financial goals that I must achieve before year 2014 ends. On my third goal is to open an equity fund in Philequity.......and finally I did it, I received a confirmation from Philequity last week.

It was my plan to open an equity fund in PEMI first last July but thrice I called their main branch & they specifically informed that I need to apply personally in their office to open an account but the problem is I can't sacrifice my one day work since we've got a lot of workloads these days & their main branch office is a bit far from us. With the help of Ms. Millete (mileti) who commented on my blog, she referred me to Ms. Tina of Rampver Strategic Advisors. I personally went to their office in Ayala to open a Philequity Fund before heading back to work. Though I was not able to meet her personally I was assisted by her colleague and after just one day I already received a confirmation letter from Philequity.

Financially speaking, last july I withdraw P 4,400.00 on my capital con. account and it was really intended to my initial equity fund just an additional P 600.00 is needed to have a total P5,000.00.But then something came up and P2,400.00 was used up while I lend the remaining P 2,000.00 to my officemate so it can earn an interest. It was only this September I was able to received full monthly rent from my brother though some of it were used in repairs of the house again. By October I received another house rent payment & finally set aside the P 5,000.00 for Philequity.

My financial life is a bit complicated these days as I was trying to rollover some amounts through lending, I was also trying to help my brother with his small business and some amount were used to payout some of my credit card loans. Although "masakit sa ulong magpa-ikot ng pera", I need to do this to have an additional means of income that I will use to invest esp in my mutual fund.

This November, I feel happy & fulfilled again that I was able to accomplish another goal for this year. Thanks again Ms. Millette :) for helping me achieve my third goal.

Have a great day everyone :)

It was my plan to open an equity fund in PEMI first last July but thrice I called their main branch & they specifically informed that I need to apply personally in their office to open an account but the problem is I can't sacrifice my one day work since we've got a lot of workloads these days & their main branch office is a bit far from us. With the help of Ms. Millete (mileti) who commented on my blog, she referred me to Ms. Tina of Rampver Strategic Advisors. I personally went to their office in Ayala to open a Philequity Fund before heading back to work. Though I was not able to meet her personally I was assisted by her colleague and after just one day I already received a confirmation letter from Philequity.

Financially speaking, last july I withdraw P 4,400.00 on my capital con. account and it was really intended to my initial equity fund just an additional P 600.00 is needed to have a total P5,000.00.But then something came up and P2,400.00 was used up while I lend the remaining P 2,000.00 to my officemate so it can earn an interest. It was only this September I was able to received full monthly rent from my brother though some of it were used in repairs of the house again. By October I received another house rent payment & finally set aside the P 5,000.00 for Philequity.

My financial life is a bit complicated these days as I was trying to rollover some amounts through lending, I was also trying to help my brother with his small business and some amount were used to payout some of my credit card loans. Although "masakit sa ulong magpa-ikot ng pera", I need to do this to have an additional means of income that I will use to invest esp in my mutual fund.

This November, I feel happy & fulfilled again that I was able to accomplish another goal for this year. Thanks again Ms. Millette :) for helping me achieve my third goal.

Have a great day everyone :)

The Story of our House, The Story of my Life - Part 3

|

| ....our second house in Taguig, where my brother is living. |

After I finished paying the first lot, the lot beside our house was then again offered to us.

April 2004 when I bought the second lot (42 sqm), the right was sold to us @ P 156,000.00 by the same tenant again. I took the risk again - handed him a down payment of P 100,000.00 cash while the remaining balance will again be paid in installment as per agreement.

How did I come up with that P 100,000 pesos in just one year?

Year 2002 I finished paying for the first lot. By year 2003 I started saving again and all the SSS loan, Pagibig loan, & the 13th month pay I received that year were all tunelled to my capital contribution account in Villamor Air Base which earns 23% per annum.

And by April 2004 I have approx P 40,000.00 & my brother also had P 50,000.00 in that account which I borrowed & promise to pay him in full with its corresponding interest from that account. But the problem is it can only be withdrawn every six months otherwise it will not earn an interest. So I borrowed P 92,000.00 from my officemate & promise to pay him in full after two months as soon as I received my savings from that cap. contribution account. And with some amount from my savings & paluwagan I was able to accumulate P 100,000.00 as initial payment for the lot.

So why did I took the risk again?

I know nothing about investing before but I do save as much as I can. But as much as I wanted to see my money grows in my bank account, I am also looking for alternative income or investment so I can be prepared if I happen to get unemployed in the future. So when the lot was offered to me with a little house in it, I took it again. My plan is to improve it & have it rented, at least I can have a little monthly income from it.

For a year I've been paying for the remaining balance of the lot & saving for the P 50,000.00 that I borrowed from my brother. And by year 2005 our company's operation shuts down but we're given a separation pay. And through that separation pay (P 56,000.00). I was able to pay the full payment of the lot & my brother as well.

Did I regret buying it?

Half of my mind is saying "Yes, I regret buying it". Have I known about investing before I would have thought of different strategy to secure my future. I would have just let my money grows in that capital contribution account & look for other lot in a location where I can do business with. And with the current situation that we are having now, I do feel some regrets buying that lot 10 yrs ago.

Half of my mind is also saying "No, I didnt". As others would say "mura na yan at tataas pa ang value nyan", but then again I have no plans of selling it now, as what my mother says "dumadami ang tao sa Pilipinas pero ang lupa hindi", talking about demography issue in the Philippines, hahah.

Did I make a wrong decision?

Yes, I did. Have I known that I would be spending approx P 100,000.00 on renovating it, I would have demolished that little house right away & build a new one with a stronger foundation. Plus a lot of years have been unproductive, with the money that I invested there.

Am I earning from it?

Yes, but.......sadly as I make the chart today the result is not good, I deducted the total expenses from the total rent & the result is negative - "After 10 yrs , hindi pa sulit o bawi, ika nga"

Why am I writing these stories?

It helps me analyze the financial decisions I made before, by tracking down the ins & out of the money that we're spent. Clearly, I can see that I have made a wrong decision but I guess I have to deal with it & look for other productive alternatives.

Decision making really plays an important factor in our financial lives & for me it's the hardest one. In every decision we make will chart the course of life we take. But wherever that decision will lead us, we have to accept it as challenge, and whatever the result is - we just have to learn from it.

Just sharing some thoughts today!

Have a great weekend guys!!!!

Note: I've been trying to live within my salary income so I can invest part of that rent to my Philequity fund. Most of my plans next year will be more on personal improvements, hopefully my financial life will go smoothly as planned.

The Story of our House, The Story of my Life - Part 2

Last week my mother & I were having a little conversation where the topic went to our house.

I asked her, " Pano yan Ma, kapag sa tenant na-award san ako kukuha ng pambayad?"

And my mother replied, " Easy ka lang wag mo munang gaanong isipin yan, me lumalaban pa naman. Isipin mo na lang kung umuupa pa rin tayo, sulit na rin ba yung ginastos natin?" well that makes sense.

I started working Feb 6, 1996 where my daily rate was only P 109.00 and I was 21 yrs old only. After few months, I was in charge of paying our monthly rent which is only P500.00 since then it has become one of my obligation to the family. Fast forward, we moved to Taguig 1998 and three to four times we moved in different houses where the rent varies from P 1,500 to P 3,000 pesos and finally we moved in our own house year 2001.

So I made a chart again assuming that we were still renting today, as what Sharon Lechter says in a podcast interview - "Numbers tell a story, so we have to be comfortable with numbers".

I just made an assumption here that every three years the house rentals we're up by P 500.00 based on my experience, on the improvements on the house & on the running house rentals here. I deducted the approx total expenses vs the total assumed rent & the result is pleasing to my eyes.

By seeing those charts above somehow made me feel good today, I think "sulit na sulit na rin yung gastos" knowing that there's a big difference between renting & taking that risk 14 years ago. I just can't imagine how hard our lives will be today, if until now we're still renting. I guess my mother knows me well to make me realize that I have to be thankful that God has given a not only a House but most importantly a Home where I am now enjoying peaceful living with my family (my father is not drinking alcohol anymore). I am only more concerned now with my parent's health. I guess I have to deal with my "worrier" attitude to keep moving.

Have a Great Day Guys!!!!

By seeing those charts above somehow made me feel good today, I think "sulit na sulit na rin yung gastos" knowing that there's a big difference between renting & taking that risk 14 years ago. I just can't imagine how hard our lives will be today, if until now we're still renting. I guess my mother knows me well to make me realize that I have to be thankful that God has given a not only a House but most importantly a Home where I am now enjoying peaceful living with my family (my father is not drinking alcohol anymore). I am only more concerned now with my parent's health. I guess I have to deal with my "worrier" attitude to keep moving.

Have a Great Day Guys!!!!

The Story of our House, The Story of my Life - Part 1

This is our house it may not look good but for me it’s the

most beautiful house in the Philippines. Why, because for me it's a dream come true - having our own house & not paying monthly rent is one of my ultimate goal in life - "simpleng pangarap, sariling bahay, sala, kusina, comfort room at kwarto sa taas."

Build through hardship & labor of love, every member of the family helped not only financially but physically contributed an effort to build that house, “lahat tumulong, lahat nag-abot ng hollow blocks, nagpala at nagmisla ng cemento”. It was also built during the hardest & the most difficult phase in my life, I was physically, family, emotionally & financially down. Physically down- I almost got an ulcer not only because I’m not eating but because I was thinking too much of all the problems I had before that cause my loss of appetite too. Emotionally down - sumabay pa ang lovelife (now u know why I’m still single today :). Family down – my father was jobless, often gets into trouble when he gets drunk so we were all crazy affected by him (baligtad sa amin-anak ang namumroblema sa ama). Financially down – zeroed & negative, "pikit-mata ang pagpagawa ng bahay" as what my mother recalls the situation. But inspite of all that hardships before I'm holding on to one thing - Faith, that God will help me get through it & eventually all those difficulties will come to pass.

Build through hardship & labor of love, every member of the family helped not only financially but physically contributed an effort to build that house, “lahat tumulong, lahat nag-abot ng hollow blocks, nagpala at nagmisla ng cemento”. It was also built during the hardest & the most difficult phase in my life, I was physically, family, emotionally & financially down. Physically down- I almost got an ulcer not only because I’m not eating but because I was thinking too much of all the problems I had before that cause my loss of appetite too. Emotionally down - sumabay pa ang lovelife (now u know why I’m still single today :). Family down – my father was jobless, often gets into trouble when he gets drunk so we were all crazy affected by him (baligtad sa amin-anak ang namumroblema sa ama). Financially down – zeroed & negative, "pikit-mata ang pagpagawa ng bahay" as what my mother recalls the situation. But inspite of all that hardships before I'm holding on to one thing - Faith, that God will help me get through it & eventually all those difficulties will come to pass.

Now this is the story of our house.

The first lot (35 sqm lot) was bought February year 2000. The right was sold to us @ P75,000 by a tenant of that area who showed us the court decision from DENR giving him the right to occupy the land but the same right was also given to those who are an actual occupant on that area. So I took the chance, handed him a down payment of P40,000 while the remaining amount (P35,000) will be paid in installment as per agreement. Then somebody advises us to build a house there,

for there were some instances that the tenant might re-sell it again if he sees

it vacant. So after a few months my mother insisted we must find a way for

that, my younger brother assembled 3 computers & sold it for P45,000 (the

starting amount when our house was built) & I needed to produce another P50,000.00

( through SSS loans, Pag-ibig MPL loans, paluwagan loans, & some loans from

my colleagues @ work) for back up (still kulang pa rin yan-) so we sometimes

borrow some construction materials to the hardware & paid it in 1 to 2 weeks.

The construction was on & off plus there were some requirements in city hall assessors ofc, meralco, nawasa

that needs to be completed for house construction. I was only earning P

P165 - P170 (8hrs/day) I think, I needed to do overtime 5 to 8 hrs overtime just to have a

salary of P1,500 to P2,000 weekly (minimum wagers are not yet exempted to tax that time). We we’re still renting that time while

paying for that lot plus the monthly bills & my brother was

still studying that time. By January

2001, I told my mother “di ko na talaga kaya ang mga bayarin, ma” so we moved

to that house even its not completed (basta may haligi, may bubong, may

kuryente, may tubig, kahit lupa pa ang sahig, puede na). Little by little we try to improve it in any way we can. By the end of 2002 we already have a two storey house & already finished paying for the lot.

So, why did I took that risk, it was only a right?

At 25, the age I have set that I must own a house & lot and my choice that time was to avail a housing loan in Pagibig or take a risk here in Taguig. But if I’m going to avail a low cost housing in Cavite, the initial problem would be the transportation fare & the house rent again since my brother & I were working/studying here in Makati & Taguig. Another factor that I need to consider was the status of my job since I’m not sure of the stability of our company back then so the possibility of foreclosure of property might also be my future problem (by 2005 – our company’s operation shuts down). These are the reasons why I choose to live here.

At 25, the age I have set that I must own a house & lot and my choice that time was to avail a housing loan in Pagibig or take a risk here in Taguig. But if I’m going to avail a low cost housing in Cavite, the initial problem would be the transportation fare & the house rent again since my brother & I were working/studying here in Makati & Taguig. Another factor that I need to consider was the status of my job since I’m not sure of the stability of our company back then so the possibility of foreclosure of property might also be my future problem (by 2005 – our company’s operation shuts down). These are the reasons why I choose to live here.

Have you ever experienced any of these:

1) Living in your relatives then after few days they will tell you that they cannot accomodate you anymore so you have to transfer to another relative's house because you have no money to pay for the rent.

2) Renting a small room with no window just door -"kapag humiga kasya lang kaming lima."

3) Living in my mother's friends garage - where the roofs & walls are made of "tapal tapal na yero" but we are so thankful that time that they allowed us to live there unlike some of our relatives who doesn't care @ all - "minsan mas mabuti pa ang ibang tao"

4) Renting a small room "pero lupa ang sahig, may papag naman kami o di ba bongga pa rin"

5) Renting a square room, studio type ika nga- sala, kusina, kwarto pero ang common ang cr sa mga nangungupahan, ewww ang cr --you know what I mean.

6) Renting a big 2 storey house but it gets flooded once it rains. Well, I enjoyed living and fishing inside the house - just kidding, once the rain stops and the flood outside our house subsides thats the time we have to clean/ "limas ng tubig" inside, thrice I caught fishes & put it in a glass jar :) Plus I have an invisible friend there who always makes me cry,hu huh.... hey I was only 11 yrs old that time.

7) Living in a house but near the common comfort rooms and its ventilation or singawan is near our window, ewww again.

8) Renting in an almost ideal house but needed to move out because the owner decided to finally live in that house.

9) Renting a house but we we're forced to move out because we haven't paid for a rent for almost a year-- I was 12 yrs old that time & I remember we borrowed "kariton" to move our stuffs.

10) The saddest part of renting is--- just when you've learned to love the house & the place, all your neighbors are kind, so many friends to play around with we just need to move out & look for another house to live.

11) Your savings always gets drained after paying for monthly deposit/advances and once you've started living in that house you'll be worried for the monthly rent again, " As always "bayaran na naman ng upa ng bahay pag katapusan"

1) Living in your relatives then after few days they will tell you that they cannot accomodate you anymore so you have to transfer to another relative's house because you have no money to pay for the rent.

2) Renting a small room with no window just door -"kapag humiga kasya lang kaming lima."

3) Living in my mother's friends garage - where the roofs & walls are made of "tapal tapal na yero" but we are so thankful that time that they allowed us to live there unlike some of our relatives who doesn't care @ all - "minsan mas mabuti pa ang ibang tao"

4) Renting a small room "pero lupa ang sahig, may papag naman kami o di ba bongga pa rin"

5) Renting a square room, studio type ika nga- sala, kusina, kwarto pero ang common ang cr sa mga nangungupahan, ewww ang cr --you know what I mean.

6) Renting a big 2 storey house but it gets flooded once it rains. Well, I enjoyed living and fishing inside the house - just kidding, once the rain stops and the flood outside our house subsides thats the time we have to clean/ "limas ng tubig" inside, thrice I caught fishes & put it in a glass jar :) Plus I have an invisible friend there who always makes me cry,hu huh.... hey I was only 11 yrs old that time.

7) Living in a house but near the common comfort rooms and its ventilation or singawan is near our window, ewww again.

8) Renting in an almost ideal house but needed to move out because the owner decided to finally live in that house.

9) Renting a house but we we're forced to move out because we haven't paid for a rent for almost a year-- I was 12 yrs old that time & I remember we borrowed "kariton" to move our stuffs.

10) The saddest part of renting is--- just when you've learned to love the house & the place, all your neighbors are kind, so many friends to play around with we just need to move out & look for another house to live.

11) Your savings always gets drained after paying for monthly deposit/advances and once you've started living in that house you'll be worried for the monthly rent again, " As always "bayaran na naman ng upa ng bahay pag katapusan"

Well I did, all of it .So if your answer to that question is no then I guess owning a house is not your priority. But if your answer is yes to most of the situation above then you'll understand why I took the risk that time.

Now the question is - Will it be ours or will it just be in my memory again? Will this be an asset or a liabilitiy to me? That remains to be seen, though most of the areas here there we're already awarded by the government. As of now still praying for a good result, but whatever the result is - I must be prepared. Worriness will do no good for me, it's a good thing I've been reading a books lately to battle my negative attitude.

Just sharing today! Happy Monday!!!!

Update on my Family's Financial Status

After I wrote a post analyzing my familys financial status last month, I realize how selfish I was not to share what I have learned & not to be concern on that aspect before. I was more focused on reaching all my personal goals not thinking that if something happens to a member of a family we will all be affected financially. I actually just want to show them how to be hardworking, to be thrifty and to be particularly financially aware but it seems like they don't care at all.

Two weeks ago I talked to my youngest brother about opening a savings account , his usual answer

"Saka na ate, pagdating ko na lng may biyahe pa ako papunta kami next week sa Lanao." He works in a govt institution (NAMRIA) where gets deploy in different provinces to do a survey for mapping research.

Ok, pagdating mo baka ubos na naman pera mo, tanong ko lang sa yo--" Ilang taon ka nang nagtatrabaho - 6 years na di ba?"

"Kaya mong magkape ng mahal o gumastos ng libo sa pagkain sa labas pero ni singkong duling wala kang kahit isang savings, ano bang plano mo sa buhay?"

"No plans pero baka raw mag-abroad sya - experience lang daw muna"

"Okay, so you are gaining experience here and I know you have the ability to fulfill that dream but you have no financial back up at all, then start saving today, it's only P 200.00 and you can already open a savings account.Whatever your plans are, "If you want to work abroad or you want to get married tomorrow" you must be ready for that.

So he showed me a jar full of 10 peso coins, ok ok cge na te - eto na lang , mamaya mag open tayo. It was Sunday we went @ MarketMarket to Wealthbank and we open a Passbook savings account and when we summed up all the coins naka-P 800.00 pa siya medyo scandalous pa ang tunog ng coins nung bilangin ng teller sa bangko, heheh. We opened an "OR" joint account so I can have access & I can easily monitor it - "Bawal mag-withdraw unless its necessary".

I showed three passbooks here - for my Kuya, my youngest brother & my passbook. Last week bunso handed me again P 1,000.00 before he left to Lanao "Te, paki-deposit ito". I'm happy he's starting to practice a financial discipline as I have told him to have just at least P 3,000.00 to P 5,000.00 savings before the year ends. I also added P170.00 to my kuya's passbook to close its balance to P1,000.00. My next goal is to convince my kuya to start saving again though it may be hard because he's older than me.

Yesterday we received this welcome letter from Wealthbank confirming our account, I put this in bunso's room so he'll be more conscious of his savings account. Not that I am promoting Wealthbank but with just P 200.00 (maintaining balance) you can open a passbook account there & P 500.00 to earn 0.25% interest. They have two branches here in Metro Manila - Market Market Taguig & Ayala Alabang but nationwide they have 17 branches already. So if you want to start to save & if you live near Market Market Taguig or Ayala Alabang you can drop by to their branch office from Mondays thru Sundays or check their website www.wealthbank.com.ph for further informations.

The chart shown here is my family's financial status I posted last month , I cannot do something for my parents since they are already old now I'm only concerned of their health but I am trying to change the mindset of my two brothers that are still living with us & has the ability to earn & save too.

By next year, my mission is to let them start making contributions on SSS,Pagibig fund, Philhealth (need to start with the basics). Hopefully they'll realize that it's for their best interest to be financially prepared and not to live a "bahala na system" an attitude that most Filipinos have.

Just in the mood for sharing! Happy Weekend!!!!

Two weeks ago I talked to my youngest brother about opening a savings account , his usual answer

"Saka na ate, pagdating ko na lng may biyahe pa ako papunta kami next week sa Lanao." He works in a govt institution (NAMRIA) where gets deploy in different provinces to do a survey for mapping research.

Ok, pagdating mo baka ubos na naman pera mo, tanong ko lang sa yo--" Ilang taon ka nang nagtatrabaho - 6 years na di ba?"

"Kaya mong magkape ng mahal o gumastos ng libo sa pagkain sa labas pero ni singkong duling wala kang kahit isang savings, ano bang plano mo sa buhay?"

"No plans pero baka raw mag-abroad sya - experience lang daw muna"

"Okay, so you are gaining experience here and I know you have the ability to fulfill that dream but you have no financial back up at all, then start saving today, it's only P 200.00 and you can already open a savings account.Whatever your plans are, "If you want to work abroad or you want to get married tomorrow" you must be ready for that.

So he showed me a jar full of 10 peso coins, ok ok cge na te - eto na lang , mamaya mag open tayo. It was Sunday we went @ MarketMarket to Wealthbank and we open a Passbook savings account and when we summed up all the coins naka-P 800.00 pa siya medyo scandalous pa ang tunog ng coins nung bilangin ng teller sa bangko, heheh. We opened an "OR" joint account so I can have access & I can easily monitor it - "Bawal mag-withdraw unless its necessary".

I showed three passbooks here - for my Kuya, my youngest brother & my passbook. Last week bunso handed me again P 1,000.00 before he left to Lanao "Te, paki-deposit ito". I'm happy he's starting to practice a financial discipline as I have told him to have just at least P 3,000.00 to P 5,000.00 savings before the year ends. I also added P170.00 to my kuya's passbook to close its balance to P1,000.00. My next goal is to convince my kuya to start saving again though it may be hard because he's older than me.

Yesterday we received this welcome letter from Wealthbank confirming our account, I put this in bunso's room so he'll be more conscious of his savings account. Not that I am promoting Wealthbank but with just P 200.00 (maintaining balance) you can open a passbook account there & P 500.00 to earn 0.25% interest. They have two branches here in Metro Manila - Market Market Taguig & Ayala Alabang but nationwide they have 17 branches already. So if you want to start to save & if you live near Market Market Taguig or Ayala Alabang you can drop by to their branch office from Mondays thru Sundays or check their website www.wealthbank.com.ph for further informations.

The chart shown here is my family's financial status I posted last month , I cannot do something for my parents since they are already old now I'm only concerned of their health but I am trying to change the mindset of my two brothers that are still living with us & has the ability to earn & save too.

By next year, my mission is to let them start making contributions on SSS,Pagibig fund, Philhealth (need to start with the basics). Hopefully they'll realize that it's for their best interest to be financially prepared and not to live a "bahala na system" an attitude that most Filipinos have.

Just in the mood for sharing! Happy Weekend!!!!

Update on my St. Peter Life Plan

I went home a little earlier yesterday, I was inside my room fixing some "kalat" in my table (billings, receipts, & scratch papers) when I saw this receipt.

Yes, this is a receipt from St. Peter Life Plan that I took almost five years ago and it reminded me that I'll finish paying this 5 yr plan on December, yeheey matatapos na ko sa pagbabayad......

Why am I excited, its a St. Peter Plan? While for some they are afraid to talk about death, I'm excited to share again the memorial life plan I took in St. Peter, hahah......

I've written a blog post last July about the St. Peter Life Plan I took year 2009.

Here's a quick overview to summarize the coverage of the 30k St. Dorothy plan, a 4in1 plan as what the St. Peter agent calls it.

1) A Memorial services worth P 30,000.00 - I'm not going to elaborate it again, we all know what it's about.

2) Accidental & Dismemberment Cash benefit - cash benefit equivalent to the pre-need price if the event happen within the paying period.

3) Life Insurance - beneficiary will receive additional cash benefit of P 30,000.00 if the planholder dies within the paying period or within 5 years after full payment and the plan holder has not reached the age 65 upon death. That only means I'm still insured for another 5 year after full payment .

4) Money Back Guarantee -this is the benefit that I want here. After paying P550.00 per month for 5 years, another 5 years of waiting and the P30,000 will be given back to the plan holder, 20% of the contract price every year will be returned to the planholder on the 11th,12th,13th,14th & 15th year.The amount maybe not be much (it's only 6,000.00 per year) but hey, pera pa rin yan di ba? After all hindi na rin talo since I'll definitely use the main purpose of this plan "pag oras ko na talaga" hahah.....ang morbid ko noh?

Note: The memorial services is assignable too but not the 3 other benefits. The money back, life insurance & the accident insurance benefits are for the planholder only but once the memorial service plan is transferred ,the planholder will lose the other 3 benefits also.

Just two more months I'll be done paying on this plan, I can add this to my portfolio and I think I'll reach my magic number on December. TARGET 100,000.00 NETWORTH THIS DECEMBER :)

PS. I'm not connected or promoting St. Peter Life Plan, this blog is just my personal knowledge of the plan I took from them 5 years ago. I think St. Peter Plan already change the contract price & the terms for their Life plans with money back, just visit their website http://www.stpeter.com.ph/page/st-peter-life-plans-with-money-back or ask their agents for further querries.

Happy Holloween!!!!

Yes, this is a receipt from St. Peter Life Plan that I took almost five years ago and it reminded me that I'll finish paying this 5 yr plan on December, yeheey matatapos na ko sa pagbabayad......

Why am I excited, its a St. Peter Plan? While for some they are afraid to talk about death, I'm excited to share again the memorial life plan I took in St. Peter, hahah......

I've written a blog post last July about the St. Peter Life Plan I took year 2009.

Here's a quick overview to summarize the coverage of the 30k St. Dorothy plan, a 4in1 plan as what the St. Peter agent calls it.

1) A Memorial services worth P 30,000.00 - I'm not going to elaborate it again, we all know what it's about.

2) Accidental & Dismemberment Cash benefit - cash benefit equivalent to the pre-need price if the event happen within the paying period.

3) Life Insurance - beneficiary will receive additional cash benefit of P 30,000.00 if the planholder dies within the paying period or within 5 years after full payment and the plan holder has not reached the age 65 upon death. That only means I'm still insured for another 5 year after full payment .